If you’re a tire dealer, people rely on your expert advice — whether you’re helping them select the right tire or informing them of situations that could make their tires unsafe. It’s part of the service that you offer, and it’s also your legal obligation. But mistakes can happen, which is where insurance comes in.

Who needs tire dealers insurance?

Anyone who runs a tire shop should have insurance — above and beyond a typical insurance policy. Commercial general liability (CGL) insurance can help protect you from common liability risks, such as a customer slipping on a greasy shop floor and injuring themselves.

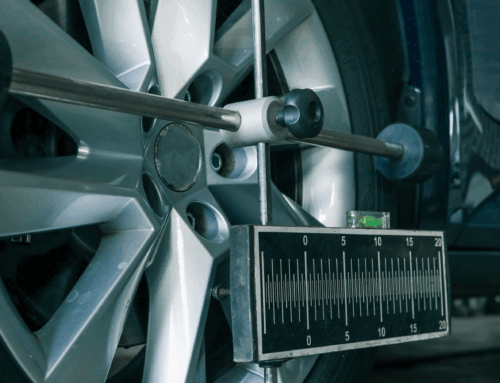

But for risks specific to tire dealers, such as improper torquing, you’ll need more specific coverages. That’s because tire shops face a number of unique risks that can result in accidents and injuries — say, a tire is defective, or work was done incorrectly by a new technician.

What are some of the risks that tire dealers face?

Failure to install the correct tire, to ensure safety systems are in working order, or to warn customers if an unsafe condition exists can all lead to liability claims. Mistakes can happen, which is why insurance for tire dealers is so important.

So, if a customer is driving and a tire becomes detached — due to improper torquing of wheel nuts or a failure in the safety system — that could have serious consequences (for the customer, and for your business). In 2022, for example, a man from Burnaby, B.C., was hospitalized after a detached tire flew across the median of a highway and smashed into the windshield of his minivan.

But this is not the only risk tire dealers face when servicing vehicles. A customer could claim that a technician made a mistake during an installation that led to a car accident. Or maybe a technician accidentally damages a tire’s rim during an installation. Or you sell a defective tire, through no fault of your own. Your shop may even be a target for theft or vandalism.

And, while all business buildings are at risk of fire, a fire in a tire shop is particularly dangerous. Tire fires can quickly escalate and cause extensive damage. Not only could this destroy your inventory, but it could damage customers’ vehicles, too. There are a number of risk mitigation techniques you can follow, such as choosing the right ceiling sprinkler system (depending on how and where your tires are stacked). Even still, a fire can be devastating to your business.

What type of insurance do tire dealers need?

There are a couple of basic coverages that every tire shop should have: Commercial general liability insurance is designed to protect your business from bodily injury or property damage claims, while commercial property insurance can help with loss or damage to your property from covered events such as fire, wind, hail, theft, and vandalism. If your tire shop does suffer damage from such an event, then business interruption insurance can help to cover your loss of income until the time you can reopen.

There are also a couple of other liability coverages that are important for tire dealers that can be bundled into your policy. For example, professional liability insurance provides installation, labour, and errors and omissions coverage, while product liability insurance may help with legal costs if a defect or malfunction in a tire causes an accident (even if it’s not your fault, you could be held liable for selling a faulty product that caused harm to the public).

Another important coverage is equipment breakdown insurance, which can help to cover the costs if essential equipment in your shop — say, a car lift or alignment machine — breaks down, leading to a loss of revenue.

Since tire shops deal with oil, lubricants, and other fluids, not only are those potential fire hazards, but there’s also the potential for environmental damage if a pollutant leaks into the ground. Pollution insurance could help to cover the costs of cleanup efforts.

You might also want to consider crime insurance, which helps to protect your business from theft, including employee dishonesty and credit card forgery. Since you have customer data on file, cyber insurance can help with the costs of data recovery, e-commerce threats, and customer communications in the event of a cyber breach.

Plus, if you make service calls and use a company vehicle (or fleet), then you’ll need commercial auto insurance.

Protect yourself and your business with insurance

No matter how diligent you are, you may still have to face unexpected challenges like equipment failure, accidental damage during installation, or liability claims for customers. To learn more, visit our Tire Dealer Insurance page today.