When it comes to insuring your vehicles, the choice between commercial and personal auto insurance is pivotal and depends on how you use them. While personal auto insurance is designed for individuals and their everyday commuting or personal use, commercial auto insurance serves the distinct needs of businesses that rely on vehicles as an integral part of their operations. This distinction can help guide you in making the right decision when it comes to your insurance coverage.

Do I need commercial vehicle insurance?

No matter what type of business you’re in and whether you roll solo or with a fleet of trucks behind you, you may want to consider commercial vehicle insurance:

- If you use a vehicle to travel site to site

Commercial vehicle insurance can be important if a typical workday finds you travelling from one customer to the next. The road can be risky, and you may need more than personal vehicle insurance to get the sort of protections that will keep your business going if you’re involved in an accident that damages your vehicle – or worse yet – causes injuries to yourself or others.If you register your vehicle to your business in Canada, you may be required to have auto insurance. But you should also consider it even if you only occasionally use personal vehicles for business purposes, like if you’re a salesperson who prefers face-to-face meetings with clients or a financial planner who typically works out of an office but also visits customers at their homes.Policies can cover multiple drivers if employees use company-owned vehicles, and if you own more than three cars, trucks, trailers, etc., consider adding fleet insurance.

- If you use the vehicle itself to perform a service

If you use trucks, trailers, or tractors to perform services such as snow or junk removal, roadside assistance, towing, etc., a commercial vehicle insurance policy is crucial. Not only are your trucks and trailers more directly tied to your business success, but large vehicles travelling at even moderate speeds can cause substantially more damage than other types of automobiles, and commercial vehicle insurance providers can consider this when setting coverage limits.

- If you transport or deliver goods, materials, or merchandise

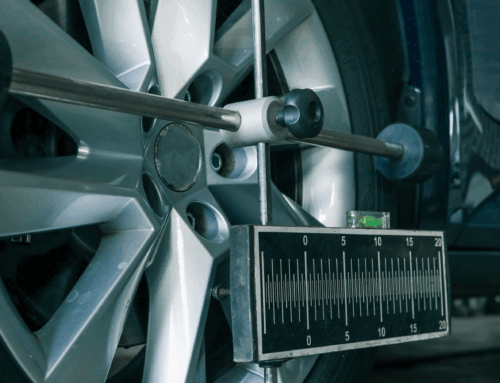

If you own a fleet of courier trucks, you know commercial vehicle insurance can be crucial. But maybe you’re just considering using your personal vehicles to earn extra money by making deliveries for various meal apps or well-known package-delivery providers. Before you make any deliveries or even sign up to be a driver, it’s essential to investigate what, if any, insurance protections the meal app or package delivery service supplies to their independent contractors. Most personal auto insurance policies won’t cover you for physical damage to or loss of your vehicle if it occurs while delivering for a meal app or courier company, let alone for collisions or accidents involving injuries.Even the most basic car repairs can be costly. If you’re determined to transport or deliver any sort of goods, take the time to update your insurance company on your plans and ensure you have an appropriate commercial vehicle insurance in place.

- If you transport customers for any reason

Whether you run a service that shuttles people to and from the airport or operate an outdoor adventure company that takes groups of hikers, canoers, and climbers to parts unknown, if you transport customers – for any reason – commercial vehicle insurance will be required.

What a commercial vehicle policy covers

A commercial vehicle insurance policy can cover cars, pickups, large trucks, multi-passenger vans, and trailers. A typical policy may include coverage for:

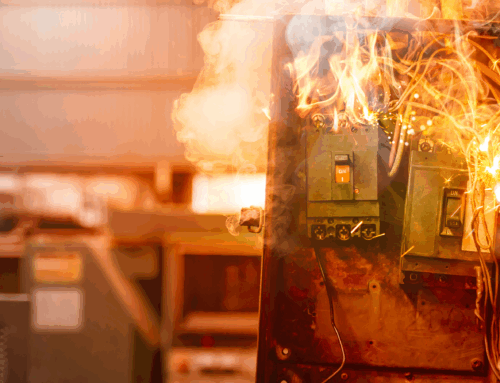

- Physical damage to your vehicle resulting from vandalism, fire, or an accident.

- Loss of your vehicle due to theft.

- Medical expenses and lost wages incurred if you, your employees, or your passengers are injured in a collision or accident.

- Liability protection for accidents with your business vehicles that damage other people’s property or that result in physical injuries to others.

- Temporary car rental or vehicle replacement following an accident involving your business vehicles.

Learn more and protect your business today!

Federated Insurance provides policies for diverse companies, from dealerships to independent building and electrical contractors, grocers, and fuel dealers. Our dedicated agents, industry experts and risk management specialists will work to develop a commercial vehicle insurance policy that lets your company stay focused on the road ahead without worrying about bumps. Complete our online quote request form or call us at 1.844.628.6800 to get started with a free, no-obligation quote now!

This blog is provided for information only and is not a substitute for professional advice. We make no representations or warranties regarding the accuracy or completeness of the information and will not be responsible for any loss arising out of reliance on the information.