Business interruption insurance is sometimes overlooked by business owners when they are looking for a comprehensive insurance package. However, this type of insurance protects a business’ financial health and helps ensure it can recover from an unexpected disruption or halt to its operations.

What is business interruption insurance?

Business interruption insurance is designed to protect a business financially if it suffers a disruption or has to close due to an unexpected event. This insurance helps the business stay afloat following the event, helping it cover important payments and also assisting with the recovery and reopening process. In essence, when funds generated by the business that are normally used to pay expenses (including payroll) are reduced or eliminated due to an insured loss, the business interruption insurance replaces those funds so that the business can continue to meet its financial obligations.

What events can business interruption insurance cover?

Business interruption insurance can cover a wide range of events. However, since not all events are covered, it is crucial to review any policy you are considering for the risks that are included, as well as the ones that are not. Here are some of the risks that might be covered by business interruption insurance:

- Natural disasters such as earthquakes, hurricanes, tornadoes, tsunamis, volcanic eruptions, floods, severe storms, hail, and wildfires.

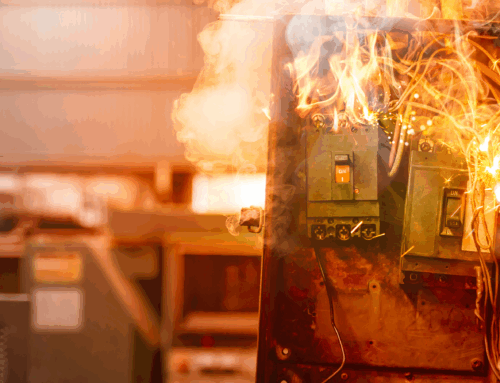

- Fire and smoke damage, including water damage caused by efforts to put the fire out.

- Physical damage to the buildings or their machinery, equipment, and stock used by the business.

- Extended electrical or utility outages if these outages caused the business to stop its operations.

- Vandalism or theft on a scale that disrupts business operations.

- Government-mandated closures which can happen with an evacuation order or during a wildfire.

- Supply chain disruptions, in which the lack of supplies makes it unfeasible to operate the business.

What costs can business interruption insurance cover?

The specific costs that a policy covers depend on the policy and the provider. Business interruption insurance may be able to pay for:

- Lost income that the business would have earned had it been able to operate normally. The amount of this lost income is based on past financial statements.

- Fixed costs that the business must continue to pay, such as rent payments, loan payments, taxes, insurance premiums, and any utilities that need to be left functioning at the premises.

- Relocation costs to a temporary location while the original location is being repaired, rebuilt, or cleaned.

- Employee wages and benefits so that the business can resume its operations as quickly as possible and does not lose critical employees.

- Training costs if the company has to purchase new equipment that is unfamiliar to the staff.

By covering these expenses, business interruption insurance can help a company that has experienced a disaster recover quickly and successfully.

What are the benefits of business interruption insurance?

Business interruption insurance has these key benefits:

- Maintaining the business’ financial health and stability

By replacing lost income and helping with overhead and ongoing expenses, business interruption insurance can help a company stay financially healthy during an otherwise disastrous situation. Without this insurance, a business might have no income at all while it is closed but could still have ongoing expenses. Depending on the length of the closure, this could be devastating for a business.

- Helping the business recover and resume its operations

Because business interruption insurance can provide help with incoming revenue and fixed expenses, the business can focus on repairing and restoring its premises, replacing its equipment, furniture, inventory, and supplies, and communicating with its customers and suppliers. Being able to concentrate on these matters makes it easier to restore the business to its pre-closure state.

- Improved risk management

Business interruption insurance can be part of a business’ overall risk management strategy. Commercial insurance serves to transfer risk to the insurance provider in exchange for regular premium payments, thereby reducing the potential for business interruptions to destabilize the company.

- Enhancing stakeholder trust

Stakeholders such as customers, suppliers, partner companies, and even nearby businesses may see a company as more professional, reputable, reliable, and trustworthy if they proactively prepare for disruptive events.

- Meeting contractual obligations and complying with laws and regulations

In some cases, contracts the business enters into may require business interruption insurance. Some jurisdictions may also legally require business interruption insurance for some types of companies.

- Peace of mind

Knowing that the business is protected from potentially catastrophic events can give owners and other stakeholders the peace of mind that allows them worry less and spend their energy growing their business instead.

Stay protected with business interruption insurance

Unfortunately, you can’t always control what happens to your business. You can, however, control how prepared you are. Having the right protection in place can make a huge difference. To learn more, visit our business interruption insurance page today.

This blog is provided for information only and is not a substitute for professional advice. We make no representations or warranties regarding the accuracy or completeness of the information and will not be responsible for any loss arising out of reliance on the information. Terms, conditions, and exclusions apply to coverage. See policy for details.