In just a matter of weeks, the COVID-19 pandemic has managed to drastically change the way we do business in Canada. Many businesses have suspended operations or switched to remote work from home tools because of public health and safety concerns.

During times like this, are you concerned with the health of your business? While the financial, social, and economic consequences of this pandemic continue to unfold, how well positioned is your business to recover?

A business continuity planning guide is an important tool your business can use to help answer these questions. It is a tailored approach to:

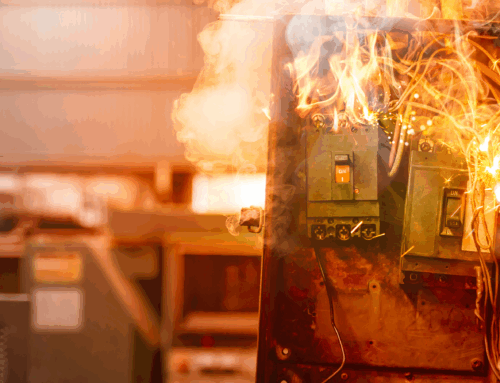

- How you will operate in a time of crisis and uncertainty

- How you will respond when disaster strikes

- How you will recover when it’s over

If you’re unsure of where to start, we’ve put together a comprehensive guide that will walk you through this process. You can use it to assess your preparedness and inform decisions about what policies or processes to implement.

We also outline considerations for:

- The different phases of an emergency response plan

- How to sustain and support critical processes

- How to assemble a business recovery team

- Understanding the different alerts issued by external agencies

A solid business continuity plan will help minimize any harm or disruption caused by a pandemic or crisis. While you may not be able to control every situation, you do have some control over how quickly you recover and carry on business as usual!

Learn more about business continuity.

Download our Business Continuity Planning Guide now!

Other important resources to help your business during COVID-19:

The Government of Canada’s support plan for businesses

Coronavirus disease (COVID-19): Being prepared

This blog is provided for information only and is not a substitute for professional advice. We make no representations or warranties regarding the accuracy or completeness of the information and will not be responsible for any loss arising out of reliance on the information.