Across the country, hail is a severe weather hazard that can damage commercial assets, public infrastructure, homes, vehicles, and crops. According to the Insurance Bureau of Canada (IBC), the August 5, 2023, hailstorm in Alberta became the second-largest insured loss event in Canadian history, causing $2.8 billion in insured damages and leading to over 130,000 insurance claims. Of these, 70,000 claims were vehicle-related, with auto damage costs alone estimated at $900 million.

Hail is formed inside thunderstorm updrafts, which creates pellets of ice that can range in size from a pea to a golf ball—and sometimes larger. Once hailstones are the size of a quarter or larger, they can cause significant damage to roofing, vehicles, and crops, and wind-driven hail can fall at an angle that rips apart siding and breaks windows. But damage isn’t always obvious; holes in roofing, for example, can lead to leaks behind walls, creating water and mould problems down the road.

While Alberta often makes headlines for its severe hailstorms, hail can affect any region in Canada — typically between June through September.

Steps to mitigate hail damage

Here are some steps to help reduce hail-related risks:

Protecting your A/C units

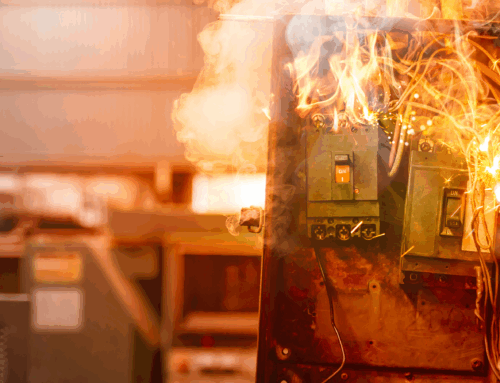

A common issue is damage to rooftop or unprotected air conditioning units on commercial and industrial buildings from hail and strong winds. The foils within these units are particularly vulnerable, often leading to high replacement costs.

The insurance deductible for rooftop A/C units tends to be high, since they’re so susceptible to damage. In some cases, insurance companies are pro-rating hail damage rather than offering a deductible.

One way to mitigate damage is to place a specially designed cage around the A/C unit that allows for proper airflow. Shielding the unit can significantly reduce the deductible. In cities like Calgary, most commercial buildings incorporate this protection as standard practice.

Address water damage on your roof

- Once hailstones punch a hole in a roof or tear through siding, there’s also the possibility of water damage. Regularly inspect your roof for potential vulnerabilities before hail season, because water damage could end up being a much, much larger claim.

- Consider implementing a longer-term solution, like replacing roofing with impact-resistant materials, particularly for properties in a moderate to high-risk hail zone. Proper roof cladding is also essential in protecting against water infiltration. On new builds or when re-roofing, consider Class 4 shingles or impact-resistant materials such as rubber or metal.

- Asphalt shingles are the most common roof covering in Canada, but they’re also prone to damage from wind, rain, and hail. Extreme weather from heat waves to snowstorms can cause these shingles to curl or blow off, increasing the potential for water damage.

Invest in longer-term solutions

- Underwriters Laboratory (UL), a widely recognized independent organization that provides testing, inspection and certification services, has testing protocols in place for roofing materials, and impact-resistant roofing is covered under UL 2218. To receive certification, the roofing material must be able to withstand a barrage of steel balls that simulates hail. Class 4-rated roofing is expected to hold up against most hailstorms, according to UL. However, ceramic, slate, concrete, and some metals could still suffer cosmetic damage in a hailstorm.

- Replace older roof coverings with hail-resistant alternatives, like steel which is a bit heavier and more expensive. But it’s better than aluminum or copper for roofs on commercial buildings because the softer metals will become damaged from hail.

Additional preventive tips

Insurance companies may lower your deductible or give you a break on your premium if you replace your roof with hail-proof materials. The problem is that the only time to really do that is after a claim is made or when you need to replace your roof.

That’s why it’s important to mitigate risk in other ways, too — such as shielding your rooftop A/C unit and watching weather reports to be prepared for potential storms. Restaurants with patios, for example, should put away their tables, chairs, umbrellas, and heaters if a storm is approaching.

Protect your business with insurance

Hail can be unpredictable and may still cause damage despite your best efforts. However, having the right insurance ensures you’re prepared to recover quickly and minimize costs. To learn more about safeguarding your business, visit our commercial property insurance page today.

This blog is provided for information only and is not a substitute for professional advice. We make no representations or warranties regarding the accuracy or completeness of the information and will not be responsible for any loss arising out of reliance on the information.